General Liability Insurance

You want the best price on general liability insurance for your company. Compare general liability quotes today and save money!

Compare Quotes

General Liability Insurance

You want the best price on general liability insurance for your company. Compare general liability quotes today and save money!

Protect Your Company and Professionals from Claims Resulting from Using Your Products or Services with General Liability Insurance

For any business, large or small, general liability business insurance should be an essential part of your business insurance portfolio. Whether you work from an office, out of your home, or in the field, it’s important to protect your business as well as your personal assets by having good insurance coverage for unforeseen situations.

General liability insurance (sometimes called Commercial General Liability Coverage) should be the foundation you build upon to protect your company or professional practice. General liability insurance protects your business from four things (based on the limits of your coverage):

If you are in the process of starting a company, purchase your general liability insurance before you open your doors. If your business is already up and running and you have a general liability policy in place, be sure to review it periodically to make sure it’s up to date.

For the future, as your business expands and grows, it’s a good idea to increase your coverage limits and reduce your exposure to potential claims.

General liability insurance covers financial losses and the costs and damages resulting from claims up to the limit of your policy for bodily injury, property damage, personal injury (slander and libel), and perceived advertising misrepresentation. This includes all claims whether caused by you, an employee or a subcontractor.

General liability business insurance also covers the cost to defend or settle claims, even when they are fraudulent. However, keep in mind that general liability insurance typically doesn’t compensate for punitive damages that are assessed for negligence or willful misconduct. You may want to purchase a Commercial Umbrella Liability Insurance to guard against claims of that nature.

1. Bodily Injury

General liability insurance will help pay for medical expenses when a customer is injured in your place of business or by your product or service. This does not include the business owner or employees (both covered under a worker’s compensation policy required in all states – however, in some states, owners can be exempted under certain circumstances).

Example: A customer slips on a puddle of water while shopping in your store and falls injuring their back. Their injuries are significant enough to require hospitalization and they sue you to recover their medical expenses.

2. Property Damage

If you or an employee cause damage to a customer’s property, this type of insurance covers repairs or replacement.

Example: While working in a customer’s home, your repair person accidentally damages the customer’s property. The customer can sue you to recover the cost of repairing their home.

3. Personal Injury

Different than bodily injury or personal liability, personal injury is more intangible and can include slander, libel, or malicious prosecution.

Example: Your employee has a nasty encounter with a customer and posts about it on social media. The customer can claim that the public humiliation caused them undue mental anguish and sues you as the business owner for slander.

4. Reputational Harm

A recent study by Deloitte and Forbes Insights surveyed 300 leadership stakeholders who said that reputational harm was their #1 concern or risk. Brand reputation can be negatively impacted almost immediately through social media affecting the ability to do business and sell products or services.

Example: An employee makes an inappropriate comment to a customer while being inadvertently filmed. The person then posts the video on their social media page where it goes viral and damages the company’s ability to do business.

5. Product Liability

If a customer is sold a defective product that causes injury, you as the business owner can be sued even if you didn’t manufacture or assemble the product.

Example: You sell children’s playsets and inadvertently sell one with a cracked part. If the playset fails and causes injury to a child, you can be sued even though you didn’t know about the sub-standard construction of the product.

6. Advertising Injuries

This coverage protects you from claims of stolen ideas, copyright infringement, and other offenses as it relates to you advertising your business.

Example: A former partner approaches you saying your logo and colors used in advertising are too close to theirs. If the partner’s logo is trademarked, you can be sued for damages based on trademark infringement and forced to change your entire brand.

7. Damage to Rented Property

As part of a general liability policy, you are covered if there is damage to a property that you rent to house your business.

Example: If you rent a building for your business and there is an accidental fire, the property owner could sue you for damages. With this protection, your liability would be covered for the damage to the property up to the coverage limits.

General liability insurance lays a solid foundation for your business’s protection, but there are still other types of insurance policies that you may want to obtain. Businesses can consider purchasing supplemental coverage such as Employment Practices Insurance, Errors and Omissions Insurance, Worker’s Compensation Insurance, Commercial Auto Insurance, or Directors and Officers Insurance (if your business requires that coverage).

Talking with an expert can help you decide which types of coverage you need and what may be unnecessary. Check here if you want to know what insurance is required in your state. Or enter your zip code below to get a free liability insurance quote.

Get A Fast and Free General Liability Insurance Quote From Top Insurers Today. Customized Protection for Your Small Business.

No matter what industry, most businesses large and small benefit from purchasing general liability insurance coverage. Small businesses and those people that are self-employed or independent contractors should consider this type of coverage to protect their companies as well as their personal assets.

You need general liability insurance coverage if:

Sometimes, general liability insurance is included as part of a comprehensive Business Owners Policy (BOP). However, coverage in those instances is typically low and may not offer sufficient protection for your specific risk exposure. Be sure to look at specific coverages and not just the lowest price when getting a quote.

In some situations, you may be required to submit a Certificate of Insurance to prove that you have valid coverage. Lessors, banks, and vendors may want to have an in-force certificate on file as part of their insurance coverage requirements.

Read More: General Liability Insurance Certificate Explained

One industry with substantially elevated risk is general contracting or remodeling and construction. The nature of the work and the hazards presented in the workplace during a construction project create an environment where customer injury or property damage can occur. When that happens, the contractor is often sued by the customer for damages.

Customer Injuries

It happens in an instant — an employee leaves a toolbox or ladder in the middle of a construction area where a customer trips and falls or accidentally steps on a nail. You may be sued by the customer and end up paying for their medical and/or legal expenses.

This does not include injuries sustained by employees or by you as the business owner. Those incidents are covered under a worker’s compensation policy that is mandatory in all states.

Property Damage

If there is damage to a customer’s property while a job is being completed, you can be liable for the costs to repair or replace the damage. As an example, if your company is remodeling a custom home and accidentally breaks a stained-glass family heirloom, you could be on the hook for the costs to restore the work.

Libel or Slander

Your general liability insurance for Contractors protects you if sued by a competitor for advertising copyright infringement as well as libel (written text) or slander (spoken word). That means if you inadvertently use similar language in your advertising and are sued, you have protection up to the coverage limits.

Product Liability as an Add-On

Anyone in the construction or contracting field should be sure their general liability policy also includes ‘product liability insurance’ as an add-on. This will protect your business in the event of injury or damage after the completion of the work that’s deemed faulty due to workmanship.

As an example, if your plumber completed work on a customer’s bathroom sink and there was a leak that damaged expensive finishes a month later, your product liability insurance would pay for the repairs if you were sued by the homeowner.

General liability insurance for Contractors will cover:

Read More: What Business Insurance Do Independent Contractors Need?

Every business needs to carry general liability insurance at a minimum. All businesses in today’s litigious society are at risk of a general liability claim, but some businesses face greater risks than others.

A few examples include companies that operate heavy machinery, serve food or beverages, make toys or exercise equipment, rent property or vehicles, or have drivers or delivery people on the road.

If you are an accountant, you could be sued if a client is injured while on your premises. If you’re a contractor and drop a ladder on a client’s car, you could be sued. And if you make any kind of claims in your advertising that you can’t prove, you can be sued.

Even if you aren’t at fault, defending yourself against a lawsuit could mean financial ruin for you and your business. Also, keep in mind that the average amount awarded by a jury for a general liability claim is $125,000.

Without adequate General Liability Coverage, you could be forced to sell off your personal assets to repay your client or competitor. You would also have to pay for your defense and any costs associated with a judgment against you.

An annual review of general liability insurance coverage and limits will ensure your business is adequately covered for any unforeseen circumstances based on current information.

Get A Fast and Free General Liability Insurance Quote From Top Insurers Today. Customized Protection for Your Small Business.

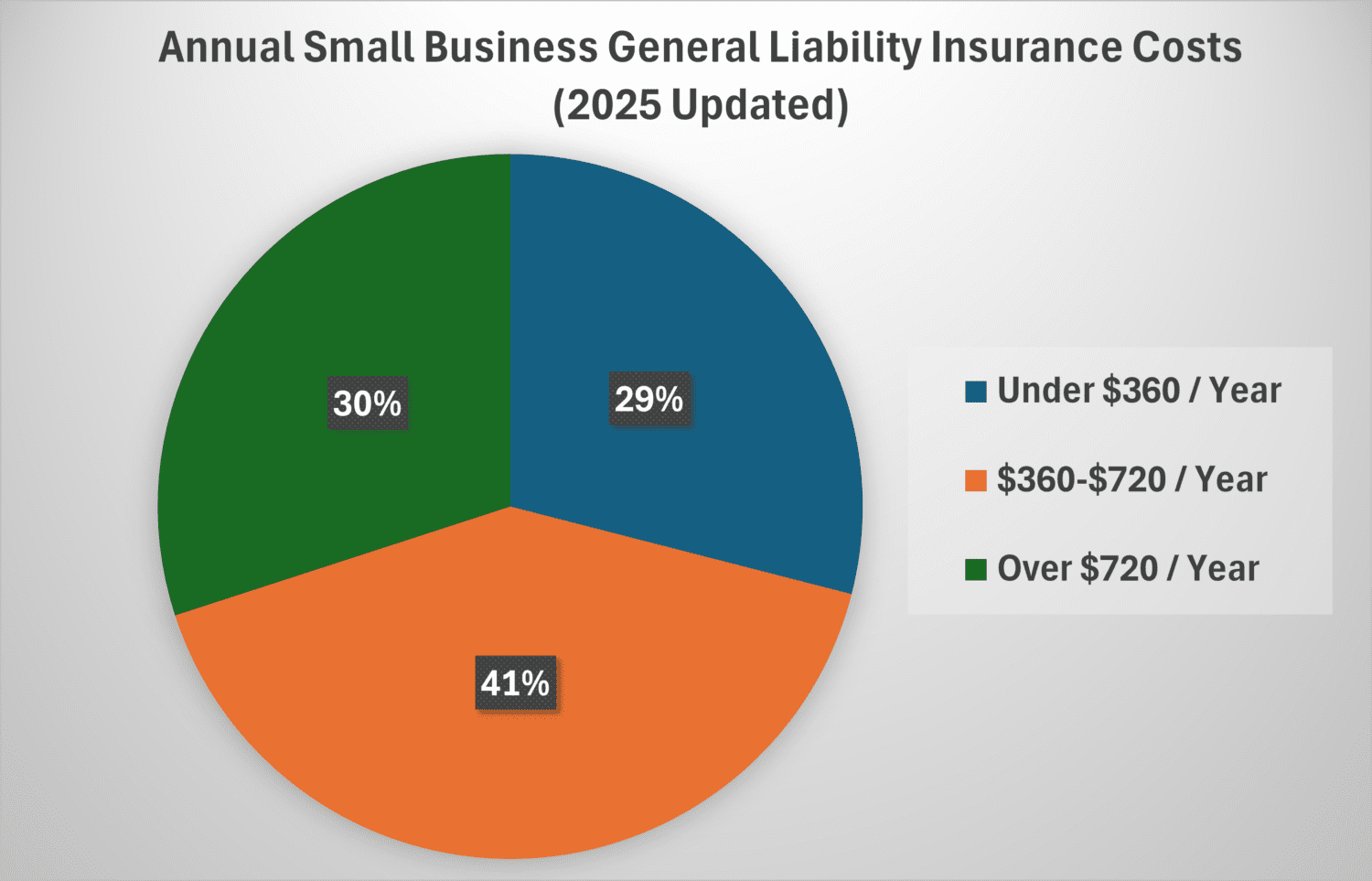

Based on your type of business, the risk level of your operations, and your policy limits, costs for commercial general liability insurance can vary. For most small businesses, the monthly average is about $42 which equates to about $500 per year. Of course, this can depend on your insurance carrier as well, so it’s important to shop around for the best quote from reputable companies.

Source: Insureon.com

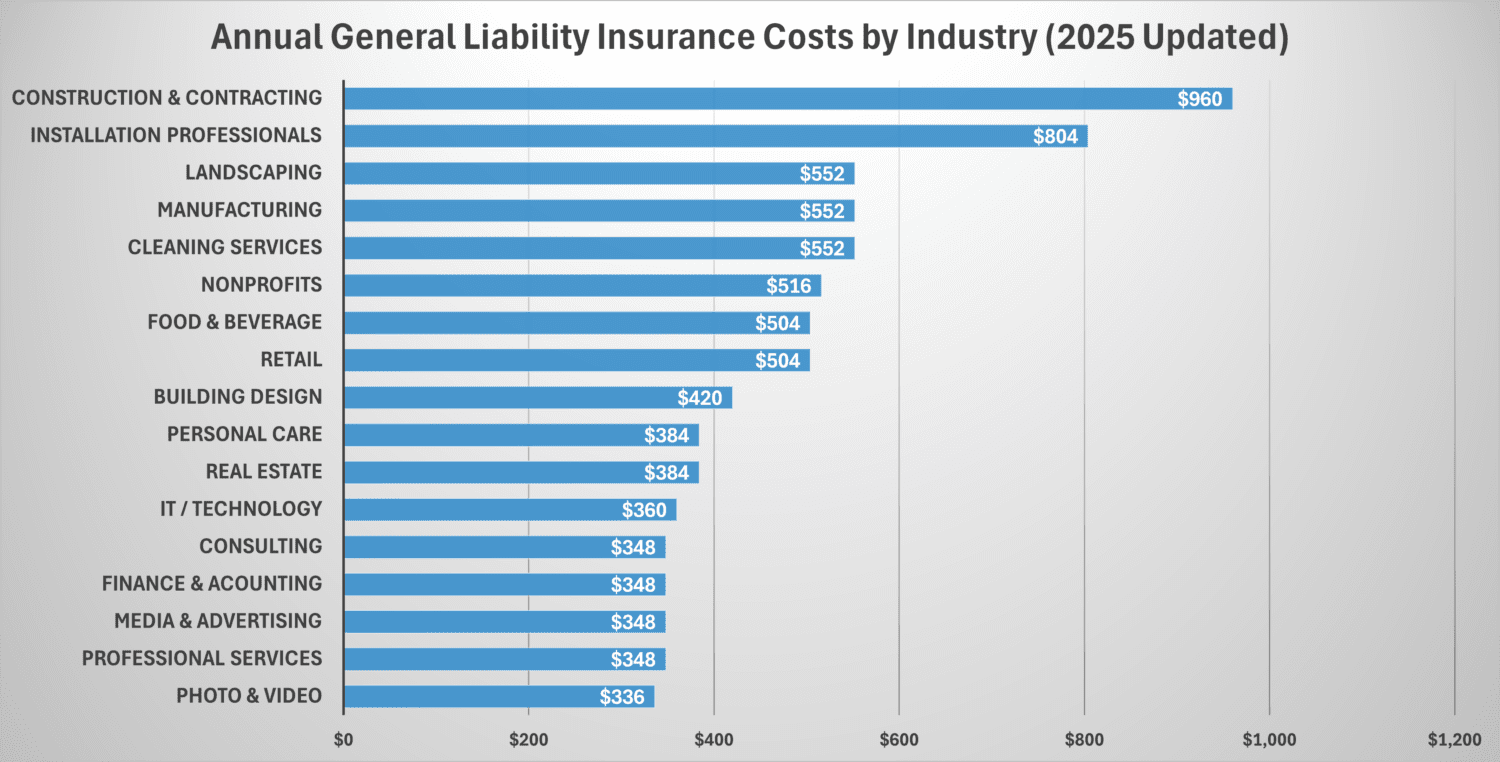

While there are multiple variables that go into pricing for business insurance costs, this table gives you an idea of the average annual cost by industry:

Source: Insureon.com

Like auto and homeowners’ insurance, there are ways to save costs which can be especially important for a new small business owner. Try some of these approaches:

There are other insurance policies for business that may make sense for your company. They can be layered on top of your General Liability policy foundation. These might include professional liability coverage, commercial vehicle coverage, or errors and omissions coverage.

By bundling your policies together with the same insurance carrier, you will often receive a discount. You might even be able to wrap some of your personal insurance policies into a cost affordable package.

Developing a comprehensive risk management plan for your small business will demonstrate to your insurance provider that you are committed to mitigating issues before they arise. A good risk management plan would include:

Consider paying your entire annual premium when it becomes due. Most companies apply an administrative fee to process monthly or quarterly payments that you would save by paying upfront.

Read More: 5 Ways to Save on Small Business Insurance

Though usually not required by law, it is highly recommended and may be required to do business with others such as lenders and lessors, or when you apply for professional licensure (real estate agents/brokers, dentists, CPAs). Having general liability insurance assures other businesses that they can rely on you and your business.

To find out what your state does require, choose your state from the map below to get insurance information specific to where you do business, including commercial vehicle insurance and workers’ compensation coverage.

Talk with an insurance expert to determine the best coverage for your particular circumstances but expect to have at least a $1 million/$2 million policy in place. This would include:

The genius of a general liability insurance policy lies in its versatility. You can add endorsements that cover specific risks and modify the overall policy for your coverage needs. Here are some of the supplemental endorsements you may want to consider based on what type of business you have:

Limited Liability Insurance

Similar to a limited liability company (LLC), limited liability insurance protects an individual’s personal assets by isolating the business’ activities in the event of litigation for liabilities that can include bodily injury or property damage. Structured for individual protection, each stakeholder in a company is responsible to obtain and carry their own limited liability insurance coverage.

Read More: Limited Liability Insurance – Do I Need It?

Employment Practices Insurance

A specific type of limited liability insurance, employment practices insurance protects you from lawsuits against your company for things like sexual harassment, discrimination, wrongful termination, or workplace misconduct. It is designed to protect your personal assets when an employee sues your company for wrongful acts.

Read More: Employment Practices Liability Insurance

Product Liability Insurance

Product liability insurance is designed to protect you when a lawsuit is filed against the company after a product fails resulting in injury. The amount to prudently carry is based on the type of products you produce. If you produce and sell weaponry, you will need far greater coverage than if you produce honey.

Read More: Do You Need Product Liability, Recall and Contamination Insurance?

Professional Liability Insurance or Errors & Omissions Insurance

This type of coverage is primarily designed to protect companies that provide professional services, including legal services, accounting, tax services, medical and dental services, and insurance services.

Often called errors & omissions insurance, it is designed to protect against claims of negligence, errors in work resulting in economic loss, copyright infringement, and personal injury. If you are sued by a client, professional liability insurance will cover your damages and legal expenses up to your policy limits.

Read More: Errors and Omissions Insurance Can Save Your Business A Lot of Money

Commercial Vehicle Insurance Coverage

Commercial vehicle coverage ensures physical damage, bodily injury, and liability for other cars or trucks are covered for all business vehicles. Coverage requirements may change by state, so be sure to visit our state-by-state guide for specific recommendations here.

This can include any type of commercial vehicle (or fleet of vehicles), including delivery trucks or vans, food trucks, box trucks, or utility vans. Like personal vehicle insurance, commercial insurance protects through liability, collision, and comprehensive coverage options.

Read More: Do You Need Commercial Auto Insurance for Your Small Business?

Cyber Liability Insurance

Whether your data is breached due to a security failure, or you suffer a malicious software attack, cyber liability insurance covers the expenses you would likely incur. Costs can add up following a cyber catastrophe, including credit monitoring for customers, notifying customers and vendors, legal fees, and ransom.

Protecting your company from a cyberattack means mitigating some of the risks with cyber liability insurance.

Read More: Does Your Small Business Need Cyber Insurance?

Hired and Non-Owned Auto Insurance

When you have an employee drive their personal car on behalf of the company, or you hire a vehicle for use doing company business, you need coverage in case there is an accident.

That can mean an assistant going to pick up lunch for a group of people or taking mail to the post office. If it’s on behalf of the company, you are at risk and should have proper insurance coverage.

Liquor Liability Coverage

Before your next holiday party, be sure that you understand the requirements and risks involved when you serve, sell, or distribute liquor. Your business would be liable if a person leaves a company function intoxicated and gets into an accident. Be sure that you have protected yourself and your business with Liquor Liability Coverage, sometimes called Host Liquor Liability Insurance.

Read More: Liquor Liability Insurance – Do You Need It?

Host Liquor Liability Insurance Explained

Additional Insured Endorsement

This type of endorsement protects other companies under the named policy. This policy addendum is intended to extend coverage or broaden protection to include another company that you might be working with in case there is a suit filed against them.

For example, a general contractor often requires the subcontractors to name them on their general liability policy. This protects the general contractor in case there is ever a customer lawsuit relating to work done by the subcontractor on behalf of the general contractor.

Read More: How to Protect Your Business with Additional Insured Status

General Liability Insurance is affordably priced, however, your quote will depend on the size and type of your business, where your operation is located, your previous claims history, and loss experience, among other factors. Coverage is typically capped at a specific dollar amount for your policy period. That’s why it’s important to fully assess your risk exposure and purchase a policy that will best protect you.

Follow these four steps to find the best coverage and price for your small business:

The first step in finding the best insurance option is to take an honest look at your risk profile to determine where your exposure lies. Consider these four things:

Today, finding quotes from fully vetted insurance brokers is fast and easy. Take advantage of the advanced automation that presents you with the companies optimally suited for your needs and then take a little time to talk to brokers until you find one that can meet your requirements now and into the future.

Be sure to compare these key components before making your general liability final selection:

Last, once you make your selection, purchase your policy and keep it up to date. It’s always a good idea to review your coverage on an annual basis and make adjustments as needed. A long-term relationship with your insurance broker can help in this process since you will have someone looking out for your best interests.

Get A Fast and Free General Liability Insurance Quote From Top Insurers Today. Customized Protection for Your Small Business.

We’ve been in the insurance industry for a long time and we think these companies as the best in the business.

With simple, streamlined solutions, Nationwide has great products and even better service.

PROs

CONs

Insurance coverage is customized to a business owner’s unique risk profile.

PROs

CONs

Backed by their long-standing reputation and over 160 years of experience.

PROs

CONs

Insurance coverage is customized to a business owner’s unique risk profile.

PROs

CONs

What Is General Liability Insurance and Do I Need It?

General liability insurance, also known as business liability insurance, protects your business from claims involving bodily injuries, property damage, and personal or advertising injuries. It is an essential policy for businesses of all sizes, as it covers a range of risks that can arise from regular business operations. While general liability insurance is not typically required by federal or state law, many businesses are required to have it due to contracts or leases. For example, landlords and clients often require proof of coverage before signing a lease or contract.

What Does General Liability Insurance Cover?

General liability insurance covers common risks such as bodily injury (e.g., a customer slipping and falling in your store), property damage, and personal and advertising injuries like libel or slander. It also provides protection against legal costs associated with defending your business in court.

What Does General Liability Insurance Not Cover?

General liability insurance does not cover employee injuries (which would be covered by workers’ compensation insurance), professional errors (covered by professional liability insurance), or damage to your own business property (which would require commercial property insurance). Additionally, intentional acts and claims that occur outside the policy period are typically excluded.

How Much General Liability Insurance Do I Need?

The amount of coverage you need depends on factors such as the size of your business, the industry you are in, and your level of risk exposure. Many small businesses opt for a standard $1 million per occurrence and $2 million aggregate policy.

How Much Does General Liability Insurance Cost?

The cost of general liability insurance varies depending on several factors, including your industry, location, and coverage limits. On average, small businesses pay about $67 per month, or $805 annually, for a standard policy.

How Can I Save Money on General Liability Insurance?

To save money on general liability insurance, consider bundling it with other types of business insurance, increasing your deductibles, and implementing risk management practices to reduce the likelihood of claims.

How Do I Choose the Right General Liability Insurance Policy?

When selecting a policy, assess your business risks, compare quotes from multiple providers, and consult with an insurance agent to ensure the coverage meets your specific needs. It is also important to review your coverage annually to ensure it remains adequate as your business grows.

Why Do I Need to Compare General Liability Insurance Quotes?

Insurance companies each have proprietary actuarial information that they use to develop their fee structures for their various insurance products. The difference in an annual quote for general liability insurance can be hundreds of dollars for near-identical coverage.

By using our quote engine, you can get valid pricing from several companies that can then flow into a highly beneficial insurance agent relationship for the company offering the details and pricing that meets your needs.

What Is a Certificate of Insurance?

A certificate of insurance is a document from your insurance company that outlines the terms of your policy. It will include things like policy coverage dates, coverage limits, any riders, or additions to the policy, etc.

You may be required to keep one on file with various businesses that you have a relationship with, such as your property owner, your bank or lender, and certain clients. Insurance companies can issue one on request electronically.

Do General Liability Insurance Policies Typically Have Deductibles?

On most plans, you can have a deductible as low as $0, but your premium costs will be higher. Or you can request to participate in a deductible plan to lower your insurance premium costs. It’s advisable for small businesses to keep liquid cash on hand to cover deductible costs for insurance so not to jeopardize the ability to conduct business.

Can I deduct General Liability Insurance Costs on My Business Tax Return?

Absolutely. The IRS allows deducting premiums for business insurance costs as a business expense on your tax returns as a Schedule C deduction. It’s considered a cost of doing business.

Does General Liability Cover Theft?

Typically, general liability coverage covers theft of third-party property. Say an employee is working in a client’s home and the client accuses the person of stealing jewelry. Your insurance policy would cover the cost to replace the jewelry if you were sued.

It usually does not cover the first-person theft when your business property is stolen. For that you would need personal property coverage for your business premise or field location.

What Is Social Media Liability Insurance Coverage?

If you use social media as an advertising mechanism, you could be subject to libel, slander, or copyright infringement accusations. General liability insurance should cover incidents of advertising injury through social media, but make sure you verify that with your insurance broker.

Does General Liability Insurance Cover Professional Mistakes?

No. Think of general liability insurance as covering tangible or physical issues, like bodily harm or injury and property damage. Professional liability insurance covers risks in the abstract, such as work product omissions or mistakes/errors that lead to financial loss for the client.

Professional liability insurance can also cover claims of negligence, inaccurate advice, or misrepresentation by you or your employees.

Will General Liability Insurance Replace Stolen or Damaged Tools or Equipment?

Theft of expensive, big-ticket equipment and tools is a major headache for business owners in the contracting field. In fact, the International Risk Management Institute (IRMI) reports that only 10 to 15% of stolen equipment is ever recovered.

Unfortunately, general liability insurance isn’t going to cover those losses.

The good news is you can get insurance that will cover equipment and tools and help to pay for the replacement or repair in the event of a theft.

Can Einsurance Help Me Get a Quote for Business Insurance In My State?

Yes, just choose your state here and find the types of business insurance you may need. Or use Einsurance’s quote engine below that allows you to fill out some basic business information and then returns multiple quotes from insurance companies interested in competing for your business.

EINSURANCE

https://www.einsurance.com/wp-content/uploads/what-does-handyman-insurance-cover.jpg

900

1200

Kathryn Morstad

https://www.einsurance.com/wp-content/uploads/Logo.png

Kathryn Morstad2025-03-27 11:00:542025-03-25 14:51:20What Does Handyman Insurance Cover?

EINSURANCE

https://www.einsurance.com/wp-content/uploads/what-does-handyman-insurance-cover.jpg

900

1200

Kathryn Morstad

https://www.einsurance.com/wp-content/uploads/Logo.png

Kathryn Morstad2025-03-27 11:00:542025-03-25 14:51:20What Does Handyman Insurance Cover? EINSURANCE

https://www.einsurance.com/wp-content/uploads/should-you-buy-cyber-insurance-for-your-small-business-thumbnail.jpg

153

300

EINSURANCE

https://www.einsurance.com/wp-content/uploads/Logo.png

EINSURANCE2023-07-13 11:00:002023-07-14 11:19:35Does Your Small Business Need Cyber Insurance?

EINSURANCE

https://www.einsurance.com/wp-content/uploads/should-you-buy-cyber-insurance-for-your-small-business-thumbnail.jpg

153

300

EINSURANCE

https://www.einsurance.com/wp-content/uploads/Logo.png

EINSURANCE2023-07-13 11:00:002023-07-14 11:19:35Does Your Small Business Need Cyber Insurance? EINSURANCE

https://www.einsurance.com/wp-content/uploads/all-you-should-know-about-commercial-truck-insurance.jpg

800

1200

Barbara Howington

https://www.einsurance.com/wp-content/uploads/Logo.png

Barbara Howington2023-06-08 11:00:492024-06-12 14:18:08All You Should Know About Commercial Truck Insurance

EINSURANCE

https://www.einsurance.com/wp-content/uploads/all-you-should-know-about-commercial-truck-insurance.jpg

800

1200

Barbara Howington

https://www.einsurance.com/wp-content/uploads/Logo.png

Barbara Howington2023-06-08 11:00:492024-06-12 14:18:08All You Should Know About Commercial Truck Insurance EINSURANCE

https://www.einsurance.com/wp-content/uploads/workers-comp-vs-disability-insurance.jpeg

800

1200

Kathryn Morstad

https://www.einsurance.com/wp-content/uploads/Logo.png

Kathryn Morstad2023-04-18 11:00:572023-04-19 10:50:22Workers’ Comp Vs. Disability Insurance

EINSURANCE

https://www.einsurance.com/wp-content/uploads/workers-comp-vs-disability-insurance.jpeg

800

1200

Kathryn Morstad

https://www.einsurance.com/wp-content/uploads/Logo.png

Kathryn Morstad2023-04-18 11:00:572023-04-19 10:50:22Workers’ Comp Vs. Disability InsuranceCompare Insurance Quotes & Save