High Deductible Health Plans – Are They Right For You?

The 2020 Open Enrollment Period (OEP) for health insurance plans is fast approaching. Many Americans will be evaluating high deductible health plans (HDHP) options as an alternative with over 45% of people under 65 years of age choosing them last year alone. These plans continue to increase in popularity as consumers seek relief from the high costs associated with their healthcare benefits.

High deductible health plans were developed a number of years ago to incentivize consumers to be more involved and directive with their healthcare dollars. One appealing aspect of HDHPs is the ability to contribute to a Health Savings Account (HSA) with pre-tax dollars to pay medical expenses including deductibles and co-pays. Keep in mind when making your decision that not all HDHPs have an HSA component.

How High are High Deductible Health Plans?

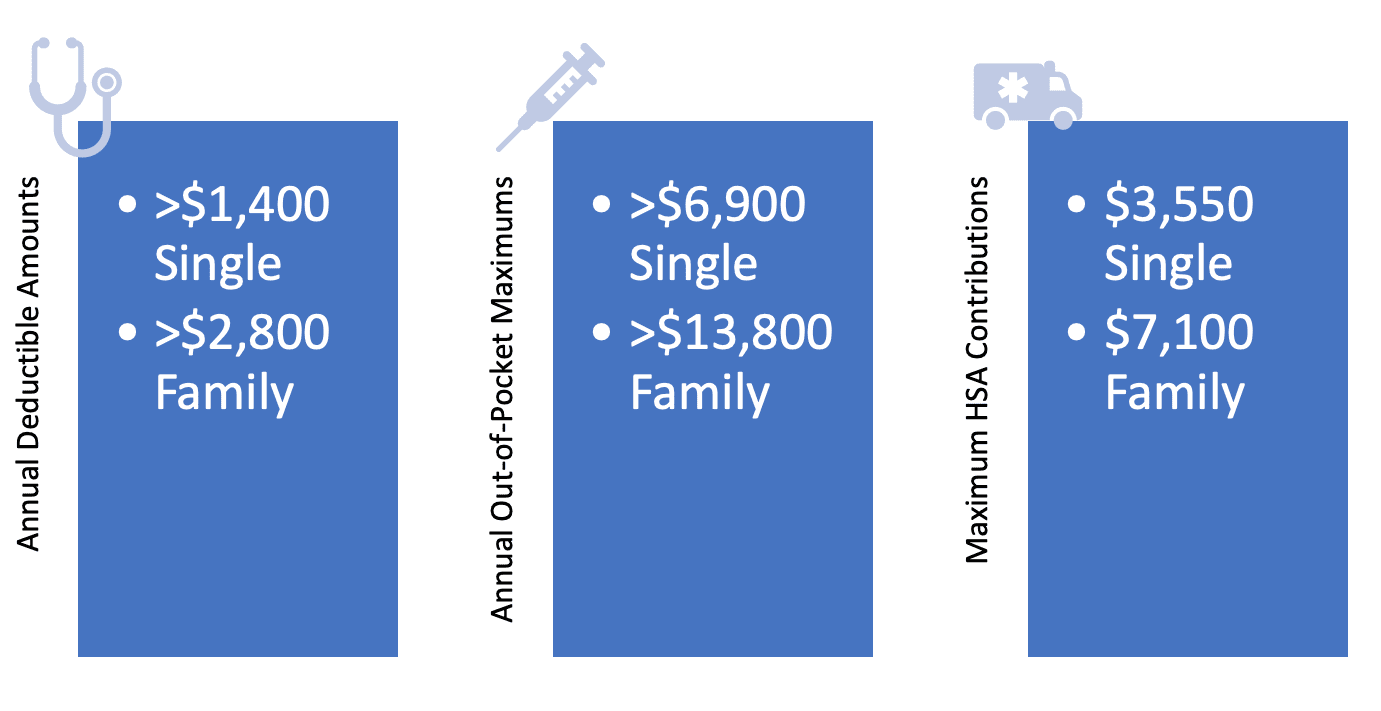

Because of the tax considerations afforded to HSA accounts, the IRS requires HDHPs to offer minimum annual deductible amounts and out-of-pocket maximums to qualify. For 2020, these amounts represent your potential financial participation for in-network care, as well as the total amount that can be contributed on an annual pre-tax basis to an HSA account:

So what are the Pros of an HDHP?

To start, the premiums are lower than a traditional plan and this saves you and your employer on average 20% or more per month. If you and your family are healthy, this can be a great savings. However, if you or someone in your family suffers from chronic disease, you would have to pay the entire out-of-pocket maximum each year before feeling any relief.

The good news:

- As you pay for services and out-of-pocket costs up to the annual deductible amount, they will be at the negotiated, discount rates that your healthcare provider contracted with the insurance payer. This amount is usually 25-45% less than the provider’s regular fees.

- Once your deductible is met, then you will only be responsible for regular copays and coinsurances up to your annual out-of-pocket maximum.

- If you reach the annual out-of-pocket maximum, you don’t pay for any services for the rest of the year. (As with any insurance, everything resets at the end of the year and the process begins again.)

- With HDHPs, once this limit has been met, the plan covers all copays, coinsurances, including medications and tests which regular plans usually exclude.

- In their own interest, most HDHPs cover preventive care with just a copay anytime during the year regardless of deductibles being met, including tests and screenings.

If an HSA is available, what does it add:

- You can open a health savings account and contribute with pre-tax dollars. You or your employer can add to it through payroll deductions to pay for qualified medical expenses/services.

- Once the plan has been opened and funded, it rolls forward each year. There is no annual expenditure required.

- HSA’s can receive money from anyone if the amount is within the annual maximum for contributions.

- The IRS has been very liberal in defining a qualified medical expense…mileage, dental, vision, prescriptions and over-the-counter medications all qualify. You are paying with pre-tax dollars so whatever tax bracket you’re in, that’s like getting that much additional money to spend.

- An HSA follows you and your family if you change to another HDHP plan. If you move to a non-HDHP insurance program, you can continue to contribute individually to the account and utilize the funds available to pay qualified medical expenses.

- Most HSA’s issue a debit card that can be used to purchase services and expenses immediately. There is no reimbursement waiting period for out-of-pocket expenditures.

- Any funds in your HSA tax-free account will continue to grow and any interest earned can be used tax free.

- Once you turn 65 years of age, you can use accrued HSA money however you see fit. However, non-medical purchases will be subject to current tax rates.

Sound too Good to be True?

It can be, so let’s look at some of the drawbacks:

- Patients with an HDHP sometimes avoid or abandon care altogether. Because of the high cost of care, physicians are finding some patients postpone being seen or skip, skimp, or discontinue medications.

- If you or a loved one has a chronic disease, such as diabetes, the financial burden can become overwhelming. Each new year, the out-of-pocket maximum must be met before there is any financial participation by insurance.

- Other than preventive care, tests and screenings, all expenses are out-of-pocket until the deductible is met.

- Often people choose this option without having the financial resources to meet the deductibles and annual maximums. If you or your family experience a catastrophic illness or accident, are resources available to meet those needs without causing undue hardship?

- While you are limited to a maximum contribution to your HSA annually, it doesn’t meet the annual maximum you could be subject to in the event of a significant health issue. Are you prepared to make additional arrangements to ensure those funds?

One thing is definitely true! Premiums continue to rise and more of the cost is being shifted by insurance payers and employers to employees. High deductible health plans seem like a terrific solution and can filter more money directly to your paycheck. They can also cause significant financial hardships if plans aren’t implemented to ensure there are adequate resources available should a serious health concern arise.

Compare Rates Online

With the annual OEP starting November 1st for the upcoming 2020 benefits year, now is the time to compare rates and secure the best options possible. If you receive benefits through your employer, be sure you understand the plan choices, costs, and implications.

If you are self-employed or not covered by an employer, you are still required to maintain coverage of a basic health plan with certain benefits. Since passage of the Affordable Care Act, there are financial consequences for being uninsured. Take time to research and fully digest what’s available through your state’s exchange.

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE