Kentucky Auto Insurance Guide

Get affordable Kentucky auto insurance quote rates for free.

Call Now: (866) 845-3808

Compare Quotes

Get affordable Kentucky auto insurance quote rates for free.

Call Now: (866) 845-3808

Kentucky drivers pay less than the national average for car insurance, but your mileage may vary if you live in a city or have a less than perfect driving record.

Key Takeaways

From Ashland to Paducah, Lexington to Louisville, Kentucky has thousands of miles of roadways. They’ll take you from downtown Frankfort to the Mammoth Caves, down the Mississippi and across the Cumberland Plateau. They’re used by over 3.5 million licensed drivers, who each travel about 11,000 miles a year.

Along the way, Kentucky’s drivers are involved in thousands of traffic accidents every day, including many that result in serious injury or death. Wherever you live and drive in the Sunflower State, carrying adequate car insurance is both a legal requirement and commonsense protection. This is your guide to Kentucky’s basic vehicle insurance requirements and laws.

Kentucky law requires you to carry a minimum amount of car insurance. Failure to do so can result in severe penalties that may include monetary fines and jail time. Kentucky is a no-fault state. That means your insurance will pay your injury claims up to a specified limit, regardless of who caused the accident. Under a no-fault system, you lose some of your rights to sue for damages.

The bare minimum car insurance requirement for Kentucky drivers is:

Kentucky alternatively allows a single-limit policy with at least $60,000 in coverage to replace these minimums.

Kentucky does not require you to carry additional coverage such as uninsured and underinsured motorist insurance or Collision and Comprehensive. However, if you own property and other valuable assets, supplementing the minimum requirements can help you protect yourself from monetary loss.

You might also consider purchasing higher limits than these minimums. For example, consider an accident involving a new vehicle. If there are heavy property damages, $25,000 may not be sufficient. The same holds true for bodily injury. Medical bills can quickly surpass the basic $25,000 minimum, which can leave you exposed to additional damages. You can buy additional Personal Injury Protection coverage to protect yourself, too.

Ask us how to calculate the right amount of coverage for your needs.

Texting while your vehicle is in motion is illegal for all drivers in Kentucky, and any mobile device use is not allowed for drivers under 18.

If you drive your vehicle seasonally —for example your RV or sports car you only drive during the warmer months – you will need to surrender your plates before dropping the insurance for the off months. Otherwise, you’ll get penalized for being uninsured once your insurance company notifies the DMV your coverage was canceled.

If you use your vehicle for ridesharing —say driving for Uber or Lyft —or if you’re a passenger in a rideshare vehicle, make sure you understand how insurance coverage works. Personal auto policies in Kentucky often exclude commercial use or rideshare use of vehicles.

You are required by law to carry proof of Kentucky car insurance in your car and show it if a law enforcement officer asks to see it. Uninsured drivers and owners may face a penalty of $500 to $1,000, up to 90 days in jail, or both. Kentucky may cancel your registration for being uninsured, too.

Insurers in Kentucky are required to provide the commonwealth with a list of insured drivers. If Kentucky does not receive notification that you have insurance, you will be sent a notice to provide evidence of coverage. If you do not provide it within 30 days, your registration will be canceled until you can provide proof.

Shopping around and comparing rates at each renewal is one of the best ways to get the cheapest car insurance policy. Remember if you haven’t shopped for car insurance in several renewal periods, your current carrier may no longer be giving you the lowest price.

Drivers who cannot obtain car insurance through the marketplace can utilize the Kentucky Auto Insurance Plan (KAIP). The KAIP is an association that helps consumers get coverage through insurers who are licensed in the commonwealth.

Simply enter your zipcode to compare car insurance rates and find the best coverage.

You may also be able to lower the cost of your premiums in the following ways:

Read More: 8 Simple Ways to Save You 90% On Your Car Insurance

The average cost for auto insurance in Kentucky is $936.91 placing it 26th in the country for costs, based on 2018 data from the NAIC.

Auto insurance companies use individual characteristics, called factors, to price your car insurance policy. Some of the rating factors used in Kentucky include:

Your age. Your age tends to affect your car insurance costs when you are very young, under 25 years old. Drivers over the age of 65 or 70 begin to also see their premiums rise due to their age.

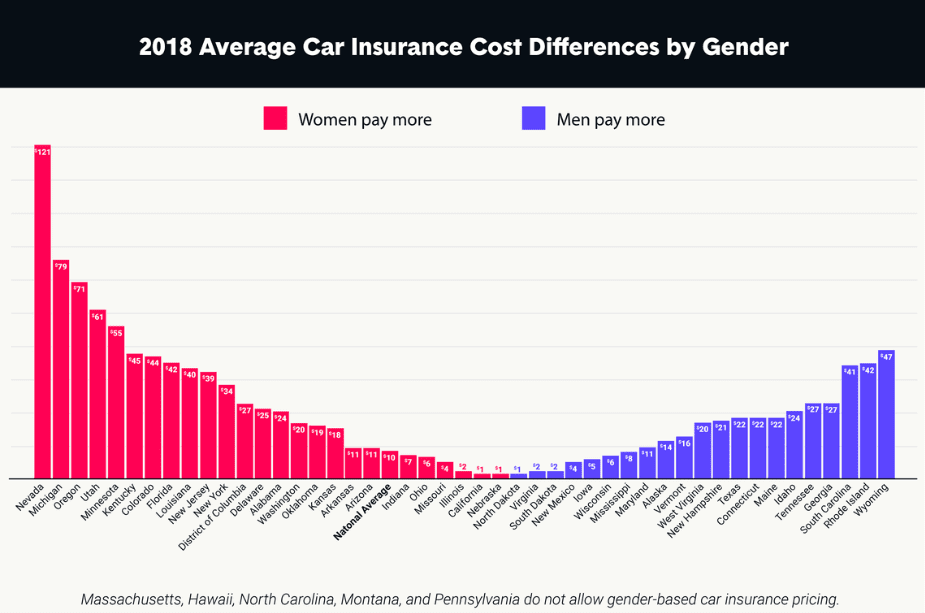

Your gender. Kentucky uses gender as a rating factor. Historically men have paid more than women when gender is a factor, but lately, the trend has switched. In Kentucky women now pay slightly higher premiums as compared with men.

Your location. Whether you reside in a more urban or rural part of Kentucky makes a difference with your premiums. Kentucky has a higher rate of uninsured drivers than many other states, with 13.9% of drivers failing to carry insurance. A high rate of uninsured drivers increases the cost of insurance for others who pay the price to make up for the uninsured population. The rate of car theft in Kentucky is about equal to the US average, which helps keep premiums lower than in locations where car theft is more significant.

The type of vehicle you drive. A newer vehicle with more safety features like antilock brakes and an anti-theft system can reward you with safety discounts on your policy. Newer vehicles can be more expensive to repair or replace in an accident, though, which increases your premium. If your vehicle has modifications or is customized, expect to pay more for your coverage since those custom parts can be expensive.

Your driving record. Your recent driving history is often a significant rating factor. Having an at-fault accident or driving ticket can stay on your record and increase your car insurance costs for at least three years in Kentucky.

How much you drive. Traveling more miles puts you at risk for more accidents, so it can cost more to insure road warriors and distance commuters.

Your credit score. Kentucky allows insurers to use your credit score to help determine your auto insurance costs. Insurance companies cannot use it as the sole means to deny you a policy, though, but it can be used as an underwriting factor when combined with other variables.

Car insurance costs in Kentucky by carrier:

| Car Insurance Company | Estimated Annual Cost |

| Kentucky Farm Bureau | $1,663 |

| Travelers | $1,480 |

| Progressive | $1,326 |

| Auto-Owners | $1,320 |

| USAA | $1,137 |

| State Farm | $1,083 |

| Geico | $922 |

Source: Market Watch Estimated Annual Car Insurance Cost in Kentucky

Car insurance rates by location:

| Kentucky City | Average Annual Premium for Full Coverage | Average Annual Premium for Minimum Coverage |

| Louisville | $2,274 | $950 |

| Somerset | $2,017 | $680 |

| Lexington | $1,662 | $656 |

Source: Bankrate Car Insurance Rates by Location in Kentucky

Women pay slightly higher car insurance premiums than men:

Source: The Zebra Study: Women Now Pay More Than Men for Car Insurance in 25 States

For help with Kentucky car insurance quotes, contact us today or simply put your zip code below and hit “Get A Quote” !

Simply enter your zipcode to compare car insurance rates and find the best coverage.

Is auto insurance required in Kentucky?

Yes. Every driver must carry the basic minimum coverage in Kentucky or face penalties for being uninsured.

Is car insurance expensive in Kentucky?

Kentucky boasts a lower-than-average car insurance cost, but drivers should shop around to find the best rates. Don’t forget to ask for discounts to lower your rate even further.

Should I shop around to compare auto insurance rates?

Shopping around to compare rates is the best way to get the cheapest price for car insurance. Many different insurance companies provide auto insurance in Kentucky so you should be able to find a competitive rate by comparing quotes with our free quote comparison tool.

My auto policy is renewing soon —should I shop around?

Yes! Your current insurer may no longer be offering you the best rate. But you’ll only know by shopping around and comparing your options. Check at each renewal, or at least annually, to be sure your current rate is the best one for you.

Kentucky Department of Insurance

Kentucky Transportation Cabinet/Motor Vehicle Licensing

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE EINSURANCE

EINSURANCECompare Insurance Quotes & Save