Renters Insurance Quotes

Rest Assured Rent with Renters Insurance

Renters Insurance covers your personal property (clothing, jewelry, computer hardware/software, electronics, furniture and other valuables) if you rent a room or an apartment. Typically, it also covers against personal liability (up to some specified amount) for those who are injured in your rental unit.

Renters Insurance quotes typically covers the possibility of damage from things like fire, smoke, lightning, wind, hail, explosions, riots, water from pipes, theft, and vandalism. It may also cover any costs associated with living somewhere else while your unit is being repaired.

What Renters Insurance Is Not

Renters Insurance is not a Homeowner’s Policy, and usually costs significantly less.

People who operate a business out of their apartments may need to purchase additional commercial insurance to protect their business interests.

Renters Insurance doesn’t protect you in the event that your landlord refuses to refund a portion of your security deposit. This is a contractual issue, not an insurance one.

Who Needs Renters Insurance?

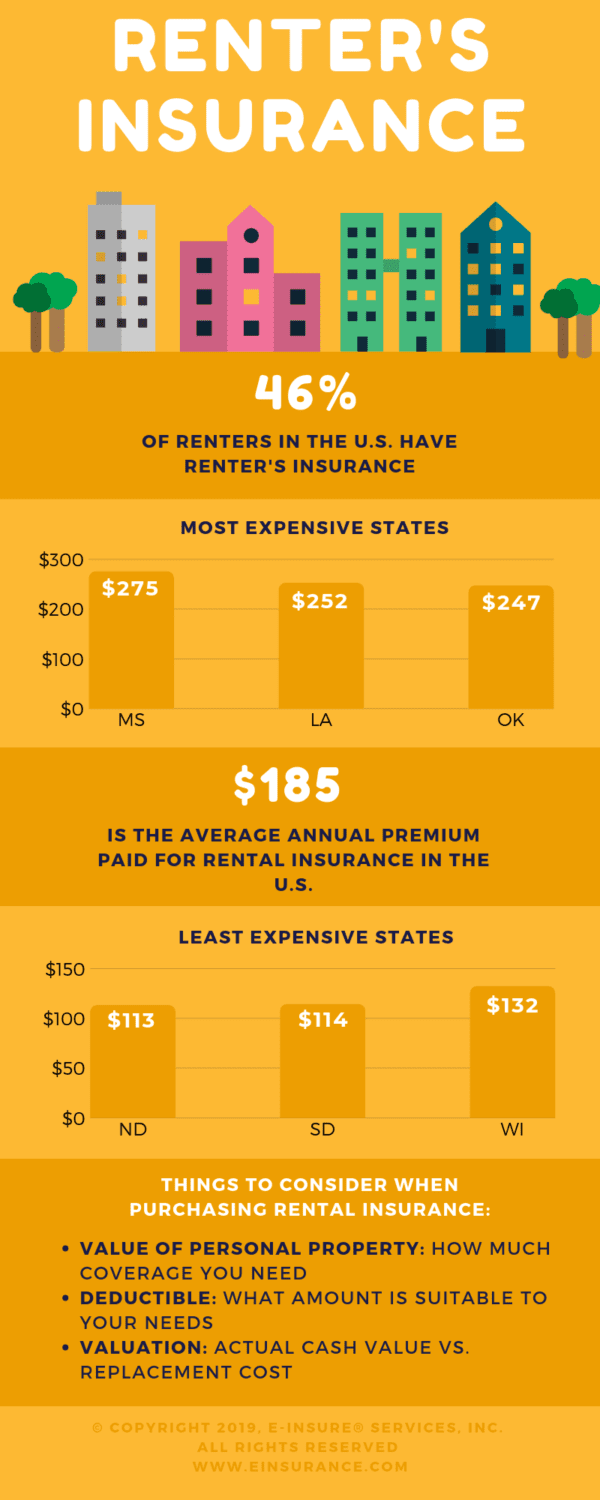

Anyone who rents living space should consider Renters Insurance (although fewer than 25% actually have a policy!). It is especially important if you have valuable items like antiques, artwork, memorabilia, jewelry, or expensive electronics that would be difficult to replace should they be damaged or stolen.

Students living away from home should consider Renters Insurance, as only a portion of their property may be covered by their parents’ homeowners’ policy. This is especially the case with students living in off-campus housing, fraternities, and sororities.

Things To Think About

The most important consideration is whether the renters Insurance quotes covers actual cash value or replacement cost of the damaged or stolen property. Actual cash value is what the item is worth today; replacement cost is what you’d have to spend to get a new one.

Like most types of property insurance, Renters Insurance may not cover loss due to floods and earthquakes. Additional coverage for these events may need to be purchased as a rider or a separate policy.

The Renters policy may limit losses for certain items like cash, computers, jewelry, silverware, furs and firearms. You may need additional coverage for exceptionally expensive items.

If you have a waterbed (and you live above someone else!), consider a policy that covers against waterbed leaks.

Two final considerations. First, does the policy cover damage or loss to your personal property when away from home? Second, if you’re a pet owner, does this affect your Renters Insurance premium? Owners of certain dog breeds (Rottweilers, Pit Bulls, Dobermans) may not qualify for liability coverage, or may have to pay a much higher premium.

Frequently Asked Questions (FAQs)

Get clear answers to common insurance questions and important details to guide your coverage decisions.

What is renters insurance and do I need it?

Renters insurance, also known as tenants insurance or an HO-4 policy, provides coverage for your personal belongings against perils such as theft, fire, and other disasters. It also offers liability protection if someone gets injured in your rental home and covers additional living expenses if you need to relocate temporarily due to a covered loss. While not legally required, renters insurance is highly recommended and sometimes mandated by landlords. It protects your personal property and offers liability coverage, ensuring you are financially protected in case of unexpected events.

What does renters insurance cover?

A standard renters insurance policy typically includes personal property coverage, liability coverage, loss of use and medical payments.

What is not covered by renters insurance?

Renters insurance generally does not cover damage from floods, earthquakes, or pests. It also excludes personal property damage due to negligence or intentional acts and typically has limits on high-value items unless additional coverage is purchased.

What are the different types of renters insurance policies?

Renters insurance can be categorized into actual cash value (pays for the value of items at the time of loss, accounting for depreciation) and replacement cost (covers the cost of replacing items with new ones without considering depreciation, which generally results in higher premiums).

How much does renters insurance cost?

Renters insurance is relatively affordable, with premiums averaging around $15 to $20 per month. The cost depends on factors like the value of insured items, location, coverage limits, and deductibles.

How much renters insurance coverage do I need?

Determine the value of your personal belongings by creating a detailed inventory. Ensure your policy covers at least this amount, and consider additional coverage for high-value items like jewelry or electronics.