Car Insurance

You want the best price for the right insurance coverage. Compare auto insurance quotes today and save money!

Call Now: (833) 389-2519

Compare Quotes

Car Insurance

You want the best price for the right insurance coverage. Compare auto insurance quotes today and save money!

Call Now: (833) 389-2519

Compare Car Insurance Quotes for Free and Get Your Best Car Insurance Rates

If you own a car, SUV, or truck, you need auto insurance. Most states require it and, let’s be honest, it just makes sense. It may seem like you’re not getting value for your hard-earned money — until you need it and then it makes all the sense in the world.

But there’s so much information you need to know and so many companies competing for your business, where do you start?

We’ve found the best place to start is at the beginning — where your personal information and the details about your car come together as a quote for the best insurance for your particular situation. So let’s get started with a quick how-to guide:

Compare car insurance quotes in seconds.

Simply put your zip code in and compare car insurance quotes from top insurers in seconds.

Basic information to fill out the form.

We’ll get you the best rates to compare. We just need a couple of simple pieces of information about you, your auto, and your driving record.

Always keep your data safe and secure.

When you compare auto insurance, we keep your personal details safe and secure.

Click, compare and save now.

Once you’ve answered the questions, just click for your free car insurance quotes.

We work with all the top insurance companies in the marketplace. Start comparing car insurance quotes online now.

Everything about you and your car make up a complex matrix that insurance companies use to make rate decisions. Based on actual (or actuarial) historic data, insurance companies assess their risk based on where you fit into this categorized blueprint. If you own a sensible, dependable sedan, your rate will be different whether you’re a 55-year-old woman or a 16-year-old man.

To get started, you are going to need to answer some questions about yourself, your vehicle, and your driving record to help auto insurance companies provide you with an accurate quote. Go ahead and gather this information and you will be ready to go:

After you fill out this information, you will get quotes from various companies. It’s important to understand what decisions you need to make before selecting an insurance offer, such as:

From there, our quote engine, using advanced technology, will send you a list of the top insurance companies offering the best rates for your situation. Then you have the opportunity to reach out to the individual companies for their best auto insurance price quotes, discounts, and bundles on the insurance that is exactly right for you and your lifestyle.

Simply enter your zipcode to compare car insurance rates and find the best coverage.

When you buy car insurance you are entering a risk-sharing arrangement. In this arrangement, the auto insurance company assumes financial responsibility in the event you suffer a loss.

In the end, the insurance company wants to make sure their risk is well placed, and they do that by assessing your personal information and driving history to determine what possible outcomes they may have in the future. With that being said, let’s take a look at the different factors used and the coverage options available so that you fully understand the process.

There are a lot of catchy, even entertaining, TV commercials today that are very effective at branding the various insurance companies. They use humor and emotions to sway you to buy your coverage from their company. I mean who doesn’t love when the giant cellphone jumps into the huge bag of rice?

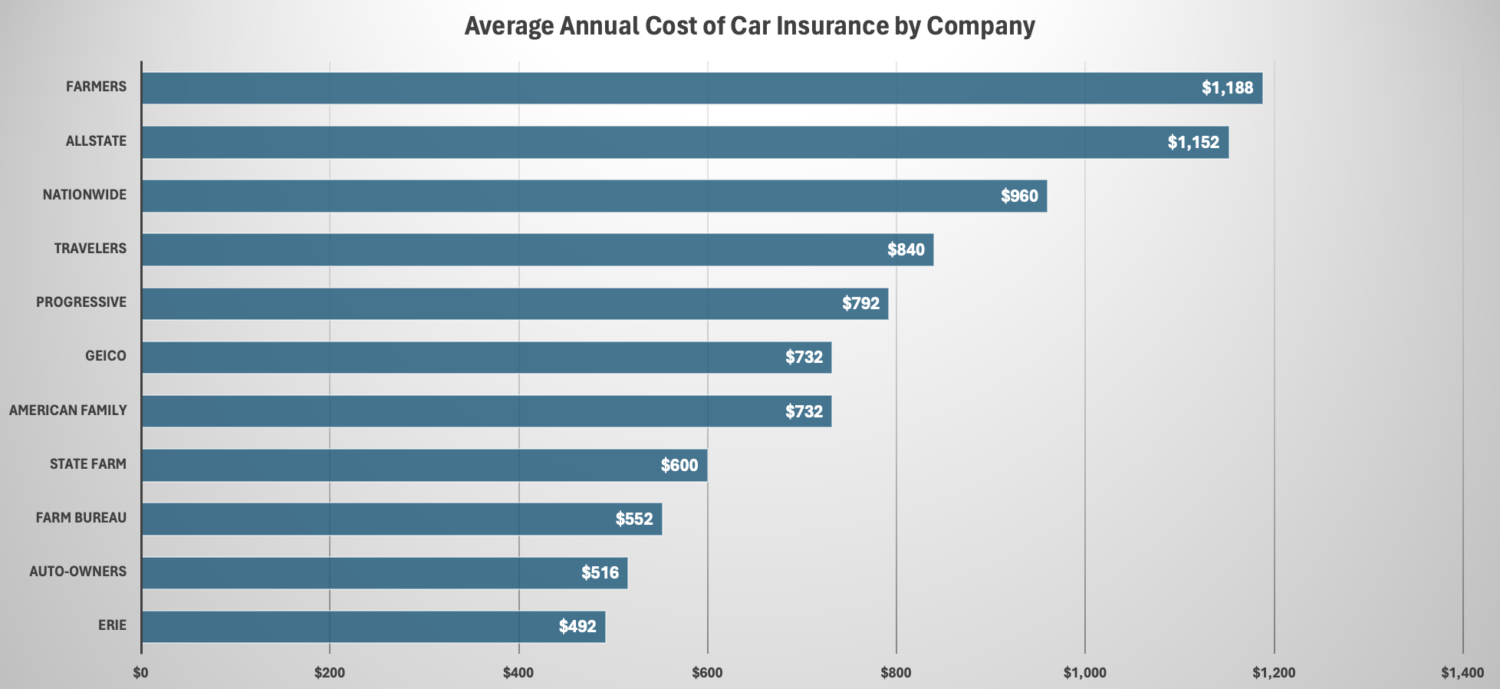

However, when it comes to selecting the auto insurance that you will pay for (and rely on) over the next year or more, it makes good financial sense to research and compare what companies are actually offering. As you compare rates, you will find that there can be a $50 to $700 difference per company per year.

Source: ValuePenguin.com

From the graph above, you can see that there is a wide range of possible car insurance quotes, and that is before you factor in the variety of options available, like coverage types, state-mandated regulations, and various discounts. It makes sense to learn all that you can and spend the time to do your research. It could save you tons of money over the years.

Simply enter your zipcode to compare car insurance rates and find the best coverage.

Let’s talk about the things that impact your car insurance rates. Everything about you and your personal choices and history goes into the equation for insurance companies. Remember, insurance companies are in the business of assessing risk and they want to make sure that before they agree to cover a person for some possible future event, they fully understand that person’s risk profile.

So how do they do that when they are insuring hundreds of thousands, or — in the case of big, national insurers — even millions of cars?

They use historical data and probability models — actuarial information — and each company gives a different weight to each factor. That is why doing a thorough auto insurance comparison with our quote engine is so important and gives you the best information to compare and make the best selection.

Let’s take a look at the factors that affect your insurance rates:

Insurance companies look at both the state where you live as well as your specific zip code to determine your car insurance prices.

Each state has different insurance laws and requirements for coverage, and it can vary widely. For example, the five most expensive states for auto insurance, according to the National Association of Insurance Commissioners, are:

| State | Average Annual Cost |

| Louisiana | $1,494.70 |

| New York | 1,436.45 |

| Michigan | $1,418.50 |

| District of Columbia | $1,415.18 |

| Rhode Island | 1,390.93 |

Source: 2023 National Association of Insurance Commissioners (NAIC)

Why, you ask? Well, in Florida, Michigan, and New York (as well as a few other states), “no-fault” insurance is required. So, in addition to the standard coverage, people are required to carry self-protection coverage. New Jersey rates are high because residents are required to carry no-fault insurance PLUS they have a very high rate of accidents in the state. And Louisiana has high insurance rates due to its risk for natural disasters and because it has poorly maintained highways and roads.

Our state-by-state map below will help you determine the insurance laws and regulations within your state.

In terms of zip codes, your rates can be impacted due to issues affecting your specific area. For example, crime or climate-related natural disasters, such as wildfires, can impact what you pay for car insurance. As an example, these five states have the highest rates of vehicle thefts that directly impact insurance rates in those states:

| State | # of Vehicles Stolen |

| California | 141,757 |

| New Mexico | 77,489 |

| Florida | 39,048 |

| Washington | 24,402 |

| Georgia | 23,776 |

Source: U.S. Department of Justice, Federal Bureau of Investigation, Uniform Crime Reports

If you are obtaining insurance in your teens and early 20s, you should expect to pay more. Insurance companies tend to increase their rates for car insurance for both males and females in this category.

Whether this is due to lack of driving experience or that younger people participate in more risk-taking behaviors, like distracted driving, the statistics bear out that this age group is more involved in fatal car crashes than any other age group. These are the top five states that experience more fatal car crashes than anywhere else:

| State | Fatalities Per 100K Population |

| Mississippi | 26.2 |

| South Carolina | 23.1 |

| Arkansas | 22.9 |

| New Mexico | 22.7 |

| Louisiana | 21.0 |

Source: www.iihs.org

For years, there has been a general perception that gender was a major factor in the amount of insurance a person was charged. It has been common to hear that men under the age of 25 are heavily disadvantaged because they are more likely, statistically, to be involved in an accident.

It has also been a common perception that women received more equitable rates because they take fewer risks as a rule.

Turns out — this isn’t true at all. With only seven states currently banning gender as a rating factor, women are paying more for auto insurance in most other states. Depending on the state and the person’s age, women are paying on average 7.6% more even though men are responsible for almost 70% of all car crashes.

Whether a fair assessment factor or not, your occupation is used by many insurance companies to help determine your insurance rates. If you are an accountant, a dentist, an engineer, a teacher, or a military officer, you will (with all things being equal) receive a lower insurance price.

However, if you are a day-care employee, a stock clerk, a retail worker, or a bank clerk, you may be faced with higher premiums.

Several states are looking at abolishing this criterion, but at this point in time, many companies still use your occupation as an indicator for your insurance risk profile.

As antiquated as the gender factor is in 2021, your marital status still holds sway with insurance companies today. In fact, according to Consumer Reports, you stand to save an average of $525 on your annual car insurance premiums as a married couple. So if you have recently been married, be sure to take a look and compare auto insurance rates — you may be in for a surprise reduction!

Similar to your occupation, many insurance companies will factor in your education level where those with advanced college degrees receive better rates than those with only a high school level education. And the higher the level, the more reduction — with advanced degrees receiving even more favorable rates.

The higher your credit score, the better your rates — it’s that simple. Your credit history is like your business card that you present to companies that you want to do business with, like insurance companies, financial lenders, or rental companies. And those companies look at your credit history and score as a big indicator of your creditworthiness and, in turn, your overall risk profile.

A credit score over 670 is considered “Good”, a score of 740-799 is considered “Very Good”, and if you have a score above 800, it is considered “Excellent”. Be sure you understand your score and history, and if improvements can be made, it’s a good idea to make them before revisiting things like your insurance rates.

When you compare car insurance quotes, your driving record will play a big part in rounding out your risk profile in the eyes of the different insurance companies. Insurance companies look at your driving record as a blueprint of things to come. If you have several tickets on your record or have been in an accident, that will impact your insurance rates and you won’t get the best car insurance quotes.

If you have had a DUI, the issues become more complex and more costly. If you still have a license to drive, your coverage will skyrocket as much as several hundred dollars per year and many insurance companies may outright cancel your policy.

If you lose your license for a court-determined period of time, you still need to insure your car until your license is reinstated. When this happens, you aren’t able to operate your vehicle, but you want to keep, insure, and maintain your car until you can drive again. If you don’t, you will end up with a coverage gap that will impact your future insurance rates.

Without a doubt, insurance companies will charge less for coverage if you drive a white minivan versus a red sports car. It comes down to the fact that statistically there are fewer accidents in practical cars like minivans and they are far less expensive to repair if you do get into an accident. In fact, the least expensive auto to insure is the Honda Odyssey.

If you are a “low-mileage driver”, between 5,000 and 10,000 miles per year, you may be eligible for significantly lower car insurance.

If you drive more than 10,000 miles per year or drive your car for business, you can expect a commensurate increase in your car insurance rates. Increased mileage or business driving usually means busy rush-hour driving or driving during the busiest (and most dangerous) times of the day.

When considering car insurance, there are two coverage factors you should weigh. First, it’s important to have a car insurance policy that includes the right coverage, but you also need to ensure you have the best coverage limits for your circumstances.

For instance, many experts agree that it’s prudent to increase your bodily injury liability minimum coverage to $100,000 per person and $300,000 per accident which is usually much higher than what most states require.

One way you can afford the higher limits may be to choose a higher deductible, like $500 or $1,000 per incident. Just be sure to account for the potential higher out-of-pocket expenses that you will incur should you get into an accident and plan accordingly.

Let’s take a look at the types of coverages offered by most insurance companies. Think of them as building blocks that you can choose to customize a policy that’s right for you.

The basic foundation for any insurance policy, think of liability coverage as the minimum layer for all other coverage options. Most states require you to carry bodily injury liability (or compulsory) coverage.

It includes two components: 1) bodily injury liability coverage, and 2) property damage liability coverage, and pays for the other driver’s medical care and property repairs up to your limits if you are at fault in an accident. Again, as stated above, most insurance experts recommend, at a minimum, $100,000 in bodily injury coverage and $300,000 in property damage, and a supplementary rider for uninsured motorist coverage.

If your coverage limits are written in a form similar to 50/100/50, you should read that as $50,000 in bodily injury liability per person/$100,000 in bodily injury per accident/$50,000 in property damage coverage.

According to the Insurance Information Institute, in 2022, bodily injury claims averaged $24,211 and property claims averaged $5,313 per occurrence. That doesn’t mean that you necessarily want to align your policy with these limits, however. With the rising costs of healthcare, it’s better to choose wisely when developing your overall car insurance policy.

Collision coverage pays for any damage to your car following an accident and only covers the car itself — not any passengers or other drivers involved. Collision coverage isn’t required by most states but will be mandated if you have a lienholder on your vehicle like a bank, finance company, or leasing company.

If you are ever in an accident, collision coverage ensures your car’s value will be reimbursed (less the deductible that you pay). Without it, you simply lose that money and are without a vehicle.

Comprehensive coverage is an umbrella for any problems or damage to your car that’s caused by something besides an accident. This can be anything from getting your car stolen to having a large object fall on it. When you add comprehensive coverage to collision and liability insurance, you often hear it called full coverage auto insurance.

When considering comprehensive coverage, remember that it is especially helpful (and decidedly more expensive) if you live in an area that is susceptible to weather or climate catastrophes, e.g., hurricanes, tornadoes, and wildfires.

Read More: Comprehensive Insurance – All You Need to Know

In a 2021 study by the Insurance Research Council, they found that almost 13% (or one in every eight drivers) of drivers on the road are uninsured. Regardless of it being illegal in all 50 states, a large number of people continue to drive without insurance and it’s the rest of the country that pays the price through increased car insurance premiums.

Here are the five states with the highest percentage of uninsured drivers:

| State | Percentage of Uninsured Drivers |

| Mississippi | 29.4% |

| Michigan | 25.5% |

| Tennessee | 23.7% |

| New Mexico | 21.8% |

| Washington | 21.7% |

Source: Insurance-Research.org

Here are the five states with the lowest percentage of uninsured drivers:

| State | Percentage of Uninsured Drivers |

| New Jersey | 3.1% |

| Massachusetts | 3.5% |

| New York | 4.1% |

| Maine | 4.9% |

| Wyoming | 5.8% |

Source: Insurance-Research.org

If you are hit by an uninsured driver, your uninsured or underinsured motorist (UI or UIM) coverage would step in to cover your losses. You can try to sue for damages, but realistically there is usually little chance for reimbursement.

The good news about UI or UIM coverage is that you have more protection than most state-mandated minimum requirements include. Whether optional or required in your state, UI or UIM coverage is always a good buy.

Read More: Uninsured Motorist Coverage: The Ultimate Guide

Optional in most states (but it can be required if you live in a no-fault state), medical payment coverage can be very helpful even if you already have health insurance. It can be used to pay deductibles, co-insurances, and co-pays for you and any passengers in your car at the time of the accident.

It can also be used to pay funeral expenses if you or someone in your vehicle passes away as an immediate result of the accident. This type of insurance pays regardless of who’s at fault.

Read More: Personal Injury ProtectionInsurance and What Does It Cover?

Whenever you are talking about auto insurance, you have to compare actual cash value versus replacement value.

Without replacement value coverage, insurance companies will reimburse you for the depreciated cash value of your car. This can be far less than what it would take to buy your car new. Often it is less than the price of a car that is the same age, same condition as the car that you have lost.

Typically, for a nominal increase to your annual premium, it is worth adding replacement value coverage to your policy so that you aren’t left short handed when replacing your vehicle.

Read More: Actual Cosh Value Vs. Replacement Cost

Personal property coverage can be added to your car insurance policy and will cover the items in your vehicle that are not part of the car itself and are not typically covered by traditional insurance. That may include outdoor equipment or your computer or smartphone if they are stolen or damaged in the vehicle. If you drive your personal car for work and carry work-owned equipment, they should be covered by the business’s insurance policy.

High-risk coverage can be required following certain offenses, e.g., DUI, suspended license, driving without a license, a lapse in coverage, excessive tickets, and typically can be mandated for three to five years.

While SR-22 coverage is used in most states, FR-44 is only used in Florida and Virginia. Either type of coverage is reported to your state motor vehicle agency and can increase your car insurance rates by up to 70% or more.

Read More: SR22 Insurance: What Does It Cover?

The good news when you compare insurance quotes is that many companies offer a variety of auto insurance discounts that help you save money. Every company is different and their offerings may change, but here are some of the most popular discounts available:

No Moving Auto Violations — Just like your car insurance quote can increase if your driving record shows tickets or moving violations, your ability to demonstrate that you haven’t had any tickets benefits you positively with a discounted rate. Driver safety discounts can often be as high as 5% or 10% annually.

No Car Accidents or Claims in the Past 3-5 Years — When you have a safe driving record and have had no accidents or claims for 3 to 5 years, most insurance companies offer auto insurance discounts.

Driver’s Education and Safety Courses — For both new drivers and senior drivers, many companies offer discounts following the successful completion of driver’s safety courses through accredited schools that work with the National Safety Council.

For new drivers, this is a one-time course and discount. However, for senior drivers, insurance companies encourage taking the defensive driving course for seniors every couple of years and renew the discount every year. Not only does this save people money, but encourages seniors to take a class that gives them confidence in their safe, effective driving habits and allows many seniors to continue driving and maintain their lifestyle and independence.

Vehicle Safety Rating — Insurance companies are aware of vehicle safety ratings and apply discounts based on things like anti-lock brakes, anti-theft devices, and daytime running lights. Newer model vehicles are equipped with even more extensive safety options and insurers understand that all of this technology helps cars to be safer and less likely to experience an accident or to be stolen.

Low Driving Mileage — Perhaps you work from home or have a short commute, so you drive fewer miles. With the average driver clocking 12,000 miles per year, insurance companies will reward people who drive less than 7,500 miles annually with a low mileage discount.

Some companies require you to use some form of monitoring technology to gauge your miles, but many do not have that requirement today.

Car Storage Location and Commuting Routes — Many companies will give discounts if your car is stored in a garage or off-street when not in use. They also consider commuting routes that don’t include highways or high-crime areas for reduced rates.

Multi-Car Discounts — Insuring multiple cars through the same company is a win-win for both you and the insurer. This also applies to sports vehicles, boats, RVs, and motorcycles.

Multiple Policy Discounts — Since most national insurance companies also offer insurance services for things like homeowners, renters, and business needs, they often offer discounts to bundle multiple policies together thereby increasing their business and your savings.

Read More: Home and Auto Insurance Bundle

Favorable Credit History — A solid credit report/score can get you a discount since you’re seen as reliable and a good risk because you have managed your financial life positively.

Owning Your Home — When you own your home instead of renting, insurance companies reward you with a discount.

Good Grades Under 25 — For students in high school and college, good grades can help them score better rates on their auto insurance. Most insurance companies require a minimum of a B average and will require annual proof.

Read More: 8 Simple Ways to Save You 90% on Your Car Insurance

So you’ve gathered all the necessary information and selected the type of coverage that will best suit your needs — now let’s talk about some tips that will help you save money when you compare auto insurance. Use these ideas to help you find the best car insurance quotes either now or next time you are looking to save money.

Insurance rates can vary widely from one company to another. Research has shown as much as $800 on the same set of factors. So take the time to do your due diligence and check several insurance companies to get the best car insurance quotes.

It’s fast, easy, and free! It doesn’t cost a thing to fill out some basic personal information and click the “Quote” button. Think of all the time saved from the days when you had to call several different agencies and go through your information again and again — now it’s one click and you’re all set!

Insurance companies are in the business of rewarding people that pose the least amount of risk. If you use a lot of mileage over the course of a year, then it’s important to disclose that. But if you find that your circumstances have changed (like you are working from home or no longer have kids in a carpool), then let your insurance company know and ask if they can adjust your rates. It could save you money over the insurance contract term.

First, remember that if you are moving out of state, insurance laws and regulations may be different in your new state of residence that can impact your auto insurance. However, whether you are moving across the country or across town, your insurance rates may change. Be sure to look at car insurance online for quotes and notify your insurance company of your new address once you move.

Read More: Auto Insurance State Guides

Well, first — congratulations! Next, it’s time to shop for car insurance quotes online. As a married couple, you stand to gain better rates than when you were both paying individually. And you now are insuring two vehicles so you can get a multiple vehicle discount. An extra bonus — you may be moving to a safer neighborhood that has a zip code in a low-crime area that scores you an additional discount.

Read More: Car Insurance for Married Couples

Today, there are a lot of people using their vehicles to generate cash. If you drive for Uber or Lyft, there are ridesharing policies available through most of the big insurance companies. There will be added mileage, so expect an increase to your annual premiums.

Read More: Do I Need Rideshare Insurance to Drive for Uber and Lyft?

There is also a growing market for car sharing services, such as Turo or Zipcar, and even Airbnb has entered the game with van and trailer rentals. Specialized vehicle insurance such as these examples require a conversation with a qualified insurance specialist so that you can compare auto insurance quotes. Start here with your zip code:

Simply enter your zipcode to compare car insurance rates and find the best coverage.

Your credit score is used by financial companies, insurance companies, and even when renting an apartment. To get the best rates for auto insurance, it’s important to maintain a good credit score. That means getting your score in tip-top shape and then monitoring your credit reports with all three credit companies annually.

Luckily, you are entitled to a free credit report each year, one from each of the three national companies. Each year, it’s important to pull your reports online and review them for any adverse issues or unusual activity.

Read More: How Your Credit Score Affects Car Insurance?

Owning a home is part of the American dream, but it’s also an underlying factor in business decision making. Insurance companies, as well as most of the financial services sector, tend to view homeownership as a character component when making coverage or lending decisions.

You can (and should) insure your sport vehicle or boat as well as the trailer you use to haul it. Car insurance typically won’t cover towing damage and boat insurance doesn’t usually cover towing.

When towing for business, you should have a business policy that covers driving and towing any trailer, vehicle, or machinery.

Students with a B average or above are often eligible for a discount with most insurance companies. Unknown to many college students, national insurance companies recognize good grades for students up to the age of 25. So if you or a family member are currently in school, be sure to take advantage of good grades when shopping for the best auto insurance.

Read More: Car Insurance for Teens

| State | Annual Premium |

| Alabama | $2,191 |

| Alaska | $2,330 |

| Arizona | $2,556 |

| Arkansas | $2,186 |

| California | $2,701 |

| Colorado | $2,605 |

| Connecticut | $2,122 |

| Delaware | $2,613 |

| Florida | $3,941 |

| Georgia | $2,609 |

| Hawaii | $1,655 |

| Idaho | $1,416 |

| Illinois | $2,303 |

| Indiana | $1,630 |

| Iowa | $1,680 |

| Kansas | $2,619 |

| Kentucky | $2,540 |

| Louisiana | $3,609 |

| Maine | $1,497 |

| Maryland | $2,491 |

| Massachusetts | $1,683 |

| Michigan | $3,336 |

| Minnesota | $1,982 |

| Mississippi | $2,049 |

| Missouri | $3,164 |

| Montana | $2,235 |

| Nebraska | $1,984 |

| Nevada | $3,535 |

| New Hampshire | $1,625 |

| New Jersey | $2,547 |

| New Mexico | $2,204 |

| New York | $3,833 |

| North Carolina | $1,708 |

| North Dakota | $1,619 |

| Ohio | $1,498 |

| Oklahoma | $2,536 |

| Oregon | $1,846 |

| Pennsylvania | $2,790 |

| Rhode Island | $2,682 |

| South Carolina | $1,872 |

| South Dakota | $1,946 |

| Tennessee | $1,806 |

| Texas | $2,613 |

| Utah | $1,916 |

| Vermont | $1,347 |

| Virginia | $1,960 |

| Washington | $1,613 |

| Washington, DC | $2,430 |

| West Virginia | $1,858 |

| Wisconsin | $1,726 |

| Wyoming | $1,582 |

How Much Car Insurance Do I Need?

Check your minimum car insurance requirements by state to find out the specific rules and regulations, but most states require a minimum of liability insurance by law. You may also be required to show proof of insurance to register your vehicle and get license plates. But remember, minimum liability coverage may not be enough to adequately cover your responsibilities which will leave you paying out of pocket for any remaining amounts owed.

If your vehicle has a lienholder, such as a bank or leasing company, you will be required to carry full-coverage insurance to protect their investment in your car.

Exactly How Does Your Car Insurance Policy Work?

When you are approved for insurance and make your first payment, you are entering into a contract with your insurance company. They are agreeing to pay for loss or damage to your car in accordance with your contract and you are agreeing to meet whatever criteria you agreed to including making payments. Should you experience an accident or loss, contact your insurance company and their claims experts will walk you through the process as defined by their company.

What Is A Fair Price For Insurance?

Insurance is based on a number of criteria, including what state you live in, your age, your credit rating, and what type of car you drive. The easiest way to find great pricing on insurance is through our easy quote engine. Just fill out some personal information and in seconds you will have a list of the insurance companies offering the best prices for your circumstances.

Should I Pay For My Insurance Monthly Or All At One Time?

If you pay all at one time, you will usually pay much less than paying on a monthly basis. However, if monthly is a better option for you, see if your insurance company offers discounts for auto payments.

Does My Insurance Cover Driving A Rental Car?

As long as you are in the United States, most auto insurance will cover you driving a rental vehicle. Contact your insurance company if you are unsure or invest in the insurance rental companies offer – it’s usually not very expensive and could save you in the long run.

If you are overseas or out of the country, your car insurance will not cover you. Be sure to contact your insurance company or a U.S. Embassy to find out your options.

Read More: Car Rental Insurance Explained

Will My Insurance Cover Driving A Moving Truck?

Most insurance policies won’t cover driving a big moving truck and you should strongly consider the insurance offered by the truck rental company. Equally important, be sure you understand coverage for the contents – you may want to purchase cargo protection coverage to ensure your personal belongings are safe.

Read More: Do You Need Car Insurance If

EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE EINSURANCE

EINSURANCE EINSURANCE

EINSURANCECompare Insurance Quotes & Save