Workers Compensation Insurance

Compare workers compensation insurance quotes and protect your employees from work injuries.

Call Now: (844) 524-6500

Compare Quotes

Compare workers compensation insurance quotes and protect your employees from work injuries.

Call Now: (844) 524-6500

Ensure That Your Company Provides Injured Employees Monetary Awards and Eliminate Litigation with Workers Compensation Insurance

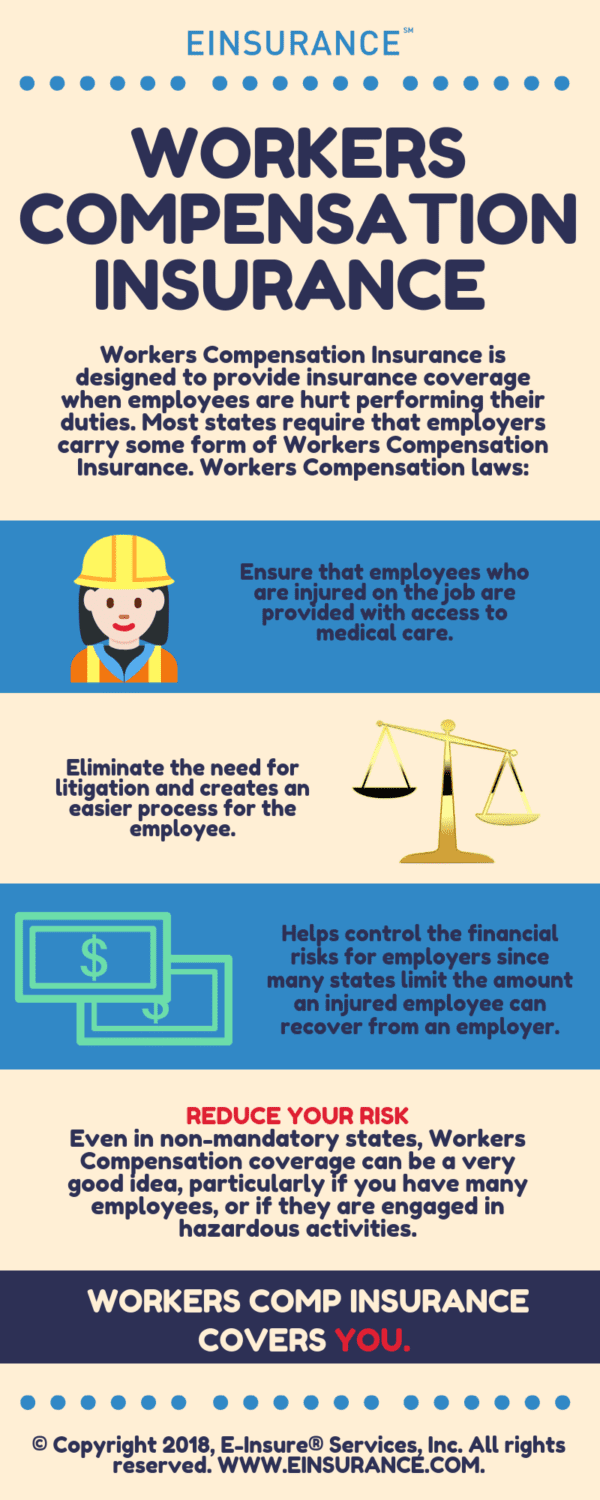

Workers compensation insurance were created to ensure that employees who are injured on the job are provided with fixed monetary awards. This eliminates the need for litigation and creates an easier process for the employee. It also helps control the financial risks for employers since many states limit the amount an injured employee can recover from an employer.

Workers Compensation Insurance is designed to help companies pay these benefits. As a protection for employees, most states require that employers carry some form of Workers Compensation Insurance.

Workers Compensation Insurance is not health insurance. Workers Comp is designed specifically for injuries sustained on the job. For more general employee health benefits, see Group Health Insurance.

In most states, if you have employees, you are required to carry Workers Compensation coverage. Even in non-mandatory states, it can be a very good idea, particularly if you have many employees, or if they are engaged in hazardous activities.

How many employees do you have? Are you in a trade or business that is dangerous? Have employees ever been hurt on the job? Does your state require you to carry Workers Compensation Insurance?

Get clear answers to common insurance questions and important details to guide your coverage decisions.

What is workers’ compensation insurance?

Workers’ compensation insurance provides medical and wage benefits to employees who are injured or become ill while working. This insurance is mandated by law in most states, protecting both employees and employers by ensuring compensation for workplace injuries without the need for lawsuits.

Who needs workers’ compensation insurance?

Most businesses with employees are required to carry workers’ compensation insurance. This includes full-time and part-time employees, though independent contractors may not need coverage depending on state laws.

What does workers’ compensation insurance cover?

Workers’ compensation covers medical expenses, lost wages during recovery, rehabilitation costs, and death benefits if the injury results in the employee’s death. It also compensates for temporary and permanent disabilities.

Does workers’ compensation cover illnesses and pandemics?

Workers’ compensation generally does not cover common illnesses like colds or flu, but it may cover illnesses directly related to job activities, especially if the nature of the work increases the risk of contracting a disease.

How much does workers’ compensation insurance cost?

The cost of workers’ compensation insurance varies depending on factors such as business location, payroll, and industry risk. Premiums are based on a classification system that groups businesses with similar workplace risks.

How can I reduce workers’ compensation insurance costs?

To lower costs, businesses can implement safety programs, undergo training, and review their claims history regularly. Discounts may also be available for businesses with a low claim frequency.

What should I consider when choosing a workers’ compensation policy?

When selecting a workers’ compensation policy, consider your state’s specific requirements, your business’s industry, and employee risk factors. Working with an experienced insurance agent can help ensure that you have adequate coverage.

How to Save On Workers Compensation Insurance For Small Business, Part I?

How to Save On Workers Compensation Insurance For Small Business, Part II?

How to Save On Workers Compensation Insurance For Small Business, Part III?

How to Reduce Your Costs For Workers Compensation?

Workers Compensation 101: A Quick Overview

What’s the Difference Between Workers Compensation and Employee Disability Insurance?

Compare Insurance Quotes & Save